By MITCH ZACKS

Federal Reserve Chairman Jerome Powell made some significant announcements at the Federal Reserve last week, but the news didn’t gain much traction in the financial media. For one, most people do not find “Fed-speak” that invigorating, or even interesting. But secondly, Powell’s pronouncements did not have any immediate impact or implications, as he was setting a course for Fed policy going forward. Market watchers mostly shrugged.

If you’re a short-term trader (which I generally do not advocate doing), this news probably does not have much meaningful impact. But for longer-term investors, I see a few key takeaways – and they’re all good for stocks.

First, a quick overview as to what the announcement means for Fed policy and possibly the economy. Chairman Powell indicated the Fed would be implementing a “flexible form of average inflation targeting,” which is a convoluted way of saying that the Fed will pursue an average 2% (or more) inflation target over time. Because the 2% target has been elusive so far, the underlying implication is that the Fed is now increasingly willing to allow inflation to drift above 2% for “some time,” given that inflation has been running under that target for such a sustained period.

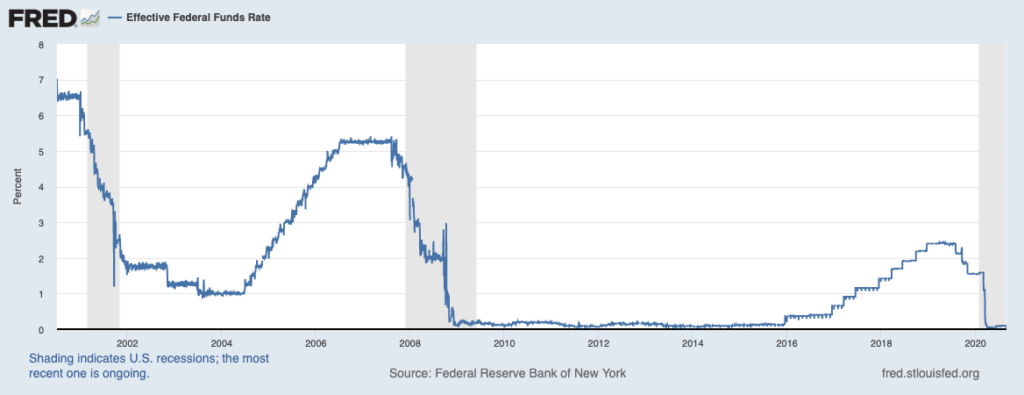

A big takeaway I see: even if inflation ticks above 2% and the unemployment rate drops back down to pre-pandemic levels, the Fed is still going to continue on with its accommodative monetary policy – which now includes asset purchases and interest rates at or near the zero bound. For investors, this means that “lower for longer” interest rates have basically been codified into Federal Reserve policy.

Source: Federal Reserve Bank of St. Louis

In my view, this pronouncement is not-so-good news for savers and fixed income investors, but it could be great news for equity investors and borrowers.

When it comes to the flow of capital, low interest rates tend to nudge investors into stocks, which is especially true in the current environment. Since the yield on the S&P 500 is materially higher than the risk-free yield on U.S. Treasuries, investors have been increasingly moving further out onto the risk curve to own stocks and capture yield. In many cases, too, the dividend yield on large or mega cap stocks often far exceeds what one can get from low risk bonds. For income-seeking retirees, this often means owning a higher percentage of stocks versus bonds.

Chairman Powell effectively said that no rate increases or slowdown in asset purchases would happen unless certain inflation and employment conditions were met, and today the U.S. economy is far from meeting those conditions. These changes bring the Fed back to the 1940’s, when Fed leaders were overwhelmingly focused on growing the labor market, and it also marks an end to the inflation-focused Fed of the 1970s. We can expect easy monetary policy for years to come, in my view, and that’s generally good news for stocks.

As far as the economy is concerned, interest rates are already at the zero bound, and the Fed is already engaged in asset purchases. So, there’s really no new stimulus here. But in my view, it is meaningful to send the message to consumers, investors, and businesses that policy will remain accommodative for a longer period of time. In a sense, that’s another form of stimulus: money is cheap and will remain so for some time.

Bottom Line for Investors

There’s an old saying that investors should not “fight the Fed,” which is a mantra I think applies today and also over the medium-term. Even without the Fed announcement, I could make a case for owning equities now based on a nascent economic recovery and expected earnings growth over the next 12 months. But if low interest rates are also a known quantity, I think it makes the case for owning stocks even stronger. The Fed just made “lower for longer” a known quantity.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!