von Mitch Zacks

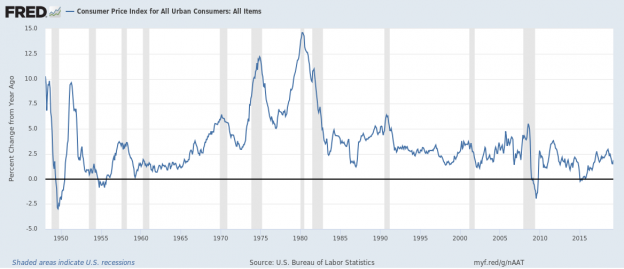

‚Inflation‘ used to be a word that, when discussed in economic circles, often dealt in worrisome implications – fear of too much inflation or concern over not enough inflation (or at worst, deflation). Rarely have we seen inflation running at subdued, acceptable levels for long stretches of time, as we have arguably seen in the last decade or so:

Indeed, from 1965 through the late 1980s, inflation posed a stubborn risk to U.S. economic health and growth. In the post-war boom with baby-boomers and women entering the workforce in droves, the Federal Reserve’s essential task was keeping inflation in check. So critical was the need to control inflation that in 1977, Congress mandated the Fed to „promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.“

The early 1990s saw the Fed’s inflation target land in the 1.5% to 2% range, and following the Great Recession, the Fed moved to make the official target 2%. As you can see from the chart above, much of the current economic expansion has featured inflation just under the Fed’s official target – even with the U.S. economy at full employment and interest rates near historic lows. The question is, why and how has inflation remained so low?

2 Reasons Inflation has not Responded to Low Interest Rates and Full Employment

So where did all the inflation go? I think you could point to two key drivers that are keeping prices in check, even without the Federal Reserve’s or other central bank’s involvement. They are: technological innovation and global supply chains.

On the technological innovation front, there is constant downward pressure on prices as technological innovation reduces the need for certain goods and services. Smartphones, for example, have reduced demand for cameras, which have driven prices lower. Technological innovation also puts pressure on its own prices, as new iterations of smartphones and other gadgets put downward pressure on the gadgets themselves. Finally, technological innovation has also increased labor productivity, thereby reducing unit labor costs. In a statistical analysis produced by the Federal Reserve Bank of St. Louis, the research found that an increase in labor productivity of three percentage points is associated with a reduction of inflation by about two percentage points.

As long as this innovation persists and creates new efficiencies in the U.S. economy, I would argue that the downward pressure on prices is not likely to subside anytime soon, regardless of the monetary policy stance of the Fed.

The existence and increasing complexity of global supply chains is another factor I would cite as a key driver of low inflation. Although it seems as though protectionist rhetoric and policy is in vogue at the current economic moment, I do not think it’s likely to impact the already existing and rapidly growing supply chains across the world. As the cost of producing goods in other countries and the cost of moving the goods across the world lower with competition and innovation, so too will prices passed along to consumers.

Bottom Line for Investors

Looking back to the original question posed in the title of this week’s column, „Is Inflation No Longer a Threat to the U.S. Economy?“, I would argue that under the current circumstances – with technological innovation and global supply chains keeping downward pressure on prices even as unemployment is historically low – inflation is arguably pretty low on the list of concerns facing the U.S. economy (and is likely to remain that way throughout 2019).

One could even make the argument that when deciding the direction of monetary policy, the Fed would be better served turning their attention to other non-inflation indicators, especially given that the U.S. is more of a services-based economy today versus a goods-based economy (as it was when the Fed was originally given its mandate). An act of Congress may be required to shift this Fed mandate, which is to say, don’t plan on it happening anytime soon.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!