By MITCH ZACKS

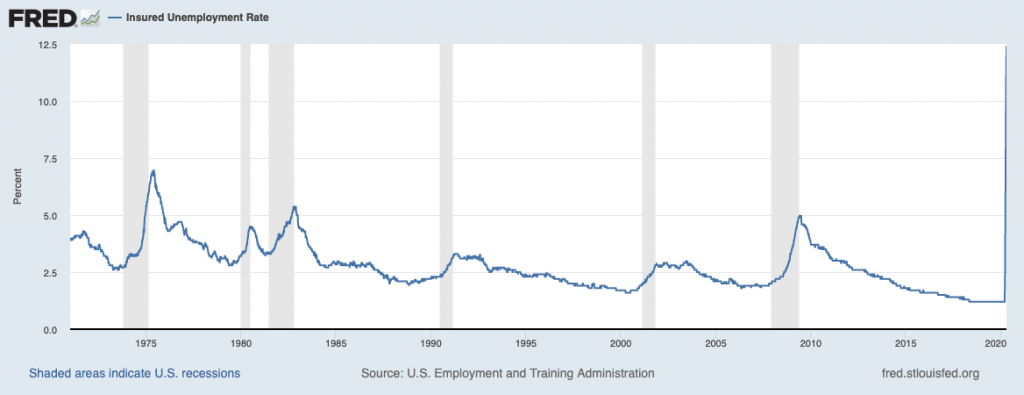

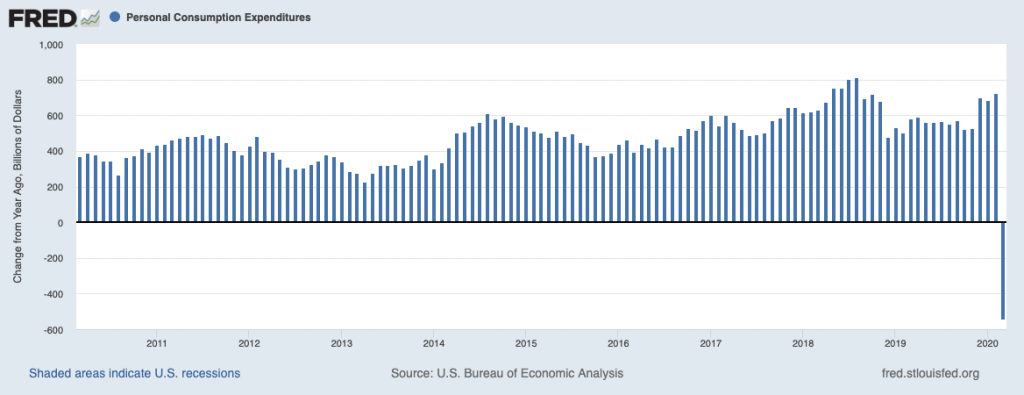

By April 18th, a record 12.4% of the US workforce was receiving unemployment benefits, with over 30 million submitting jobless claims. Estimates suggest that in the coming weeks, the unemployment rate could approach 20%, which would bring the economy closer to levels seen during the Great Depression. U.S. factory activity in April, as measured by the ISM production index, essentially ground to a halt, as did consumer purchases. The U.S. personal saving rate rose to its highest level since 1981, as consumers were either unwilling or unable to spend.

Many readers have likely seen charts like the ones below as it relates to the gravity of economic impact, with the unemployment rate dramatically spiking (top) and consumer spending falling off a cliff (bottom).

The Unemployment Rate Spiked Straight Upward

Source: Federal Reserve Bank of St. Louis

While Consumer Spending Plummeted

Source: Federal Reserve Bank of St. Louis

As the dismal economic data was blanketing the airwaves and newspapers in April, the S&P 500 marched +12.7% higher, posting its best monthly performance in 33 years. The disconnect between the economy telling one story and the stock market telling another understandably perplexes many investors. How can the stock market possibly do so well while economic conditions are so dire?

Some may argue that the market rally has everything to do with the Federal Reserve. Virtually unlimited monetary stimulus and liquidity are making its way into the stock market. Others may cite the $2.4 trillion package of government spending ‘propping up’ the economy and markets. I fully acknowledge (and support) the role that fiscal and monetary stimulus plays in stabilizing the economy and markets, but my response to the ‘disconnect’ between the economy and the stock market is much simpler: stocks have a long history of rallying in the midst of terrible news.

Take the 2007-2009 bear market, for example. When the S&P 500 hit its low on March 9, 2009, jobless claims were still rising. Jobless claims eventually peaked at the end of the month but stayed high basically until the following year (2010). The unemployment rate also kept going up throughout 2009, with a falling labor-force participation rate and a general sense that the U.S. economy was doomed. But by the end of March 2009, the S&P 500 had soared +18.1% off the low, and by the end of the year stocks had rallied +67.8%. The stock market was telling one story, while the economy and sentiment were telling another.

Taking your cues from the economic headlines of the day can be a costly mistake. For example, if a person had invested $100,000 in the S&P 500 on March 9, 2009, they would have accumulated $630,000 by the time the market peaked in February 2020. But if the investor had waited just three more months to invest (June 2009, when the economic headlines were slightly better but still bad), the same $100,000 would have only grown to $450,000. We can find examples of this type of outcome throughout history. Stocks rarely wait for good news to arrive.

One Note About Unemployment in the U.S.

As dire employment data continues in the coming weeks and months, there is a silver lining I think investors should keep in mind

A key differentiator between this recession and past recessions is that a significant number of employers are using furloughs rather than outright layoffs to trim the workforce. In theory, this means that re-starting the economy could be less stressful than after a structural recession (like 2008). When employees are asked to return to work, there’s no need for training, recruitment, job search, background checks, ‘onboarding,’ etc., all of which are costly and time-consuming. Workers can return to their jobs and immediately be productive.

Time will tell what the economy looks like in the coming months, and whether or how soon many workers will be asked to return. But I’m hopeful it will be relatively soon.

Bottom Line for Investors

Is the stock market’s rally in the face of bad news an indication that the bear market is over and the coast is clear? Simply put, the answer to that question is no – and I expect more bouts of downside volatility before this is over.

The overarching message I want to drive home here, however, is that investors should not expect the stock market to reflect what you’re reading and seeing in economic news. The stock market does not respond to what’s happening or already happened in the economy. The stock market is forward-looking, a discounter of future economic conditions. Since 1929, the S&P 500 has bottomed an average of four months before a recession officially ends. If you’re waiting for good news before investing in stocks, you’re almost certain to be too late.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!

„Nobody in America has ever seen anything else like this. This thing is different. Everybody talks as if they know what’s going to happen, and nobody knows what’s going to happen.” (Charlie Munger)

„Never, never, never bet against America.“ (Warren Buffett)