By Mitch Zacks

The CEO of JP Morgan Chase, Jamie Dimon, shared a memorable anecdote a few years back. His daughter came home from school sometime in 2008 and asked, “What is the financial crisis?” Mr. Dimon responded by saying, “It’s something that happens every five to seven years.”

Recent turmoil in the banking sector has many investors wondering if we’re on the cusp of the next financial crisis, or whether it’s already begun. In a span of just two weeks, we’ve seen the collapse of Silicon Valley Bank and Signature Bank, as well as an orchestrated takeover of 166-year-old Credit Suisse, a financial institution with over 50,000 employees. This string of events certainly makes it feel like there’s a financial crisis in the offing.

But as I’ll explain below, these institutions were largely in a league of their own in terms of their risk exposure, and each company made ill-timed and ill-informed management decisions that ultimately set them up for failure, in my view.

Let’s start with Silicon Valley Bank (SIVB).

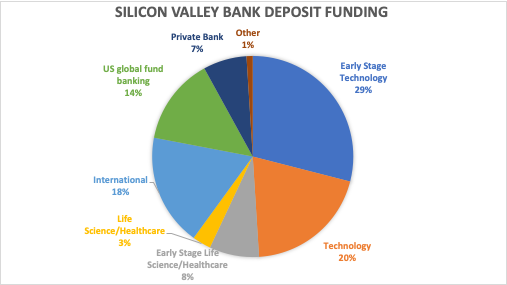

SIVB was a bank that catered mostly to early-stage technology companies, venture capital companies, and private equity firms. In the year following the Covid-19 lockdowns—when liquidity surged in the U.S. from massive fiscal and monetary stimulus—SIVB saw its deposits surge from $62 billion to $124 billion, a roughly 100% increase at a time when most banks were experiencing 20% to 30% increases in deposits. SIVB was gaining large, wealthy clients in very concentrated industries.

Silicon Valley Bank’s Deposits Were Too Concentrated

Undiversified, uninsured deposits can pose major problems for a bank. We learned last week that the Federal Reserve Bank of San Francisco started issuing SIVB citations in 2021 for the way it was handling risks. In short, the Fed flagged SIVB for not having enough cash on hand in the event of a crisis, and by July 2022, the SF Fed had put the bank in full supervisory review. By the fall, staff from the San Francisco Fed met with senior SIVB leaders about its deficient risk controls, and what the bank planned to do about exposure to losses on its fixed-rate securities portfolio when interest rates rose. SIVB was in a league of its own: unrealized losses on its books rendered its Tier 1 capital ratio as essentially 0%. SIVB largely did nothing in response.

Signature Bank

Signature Bank offers another example of poor risk management, in my view. In 2018, the bank opened its doors to cryptocurrency companies, and within three years, the share of crypto industry deposits grew from 0% to 20% of total deposits at the bank. By the end of 2022, 93% and 90% of SIVB and SBNY’s deposits were uninsured, respectively.

Times are good when “risk is on,” but when the cryptocurrency industry suffered major setbacks and the startup world saw funding evaporate, many early-stage companies (clients of SIVB) and crypto firms (clients of SBNY) drew down cash reserves to continue funding operations. It could be said that the writing was on the wall.

Credit Suisse

As for Credit Suisse, problems had been emerging for months if not years. A high level of executive turnover contributed to the Swiss lenders’ mismanagement, and they notoriously made bad bets in its alignment with now-bankrupt Greensill Capital and its $5 billion loss from the collapse of Archegos Capital Management. That’s an entire year’s worth of profits. Last October, rumors of the banks’ problems on social media led to a major outflow of wealthy clients, with deposits falling more than 40% and assets plummeting by 30% in 2022. Again, much of this writing appeared to be on the wall.

It could very well be that more bank failures are on the way, but I sincerely do not think that will be the case—at least here in the U.S. What I think we’ve seen recently is the collapse of mismanaged banks with bad risk profiles, which I confidently believe is more of an exception than a rule in the U.S. banking system.

Bottom Line for Investors

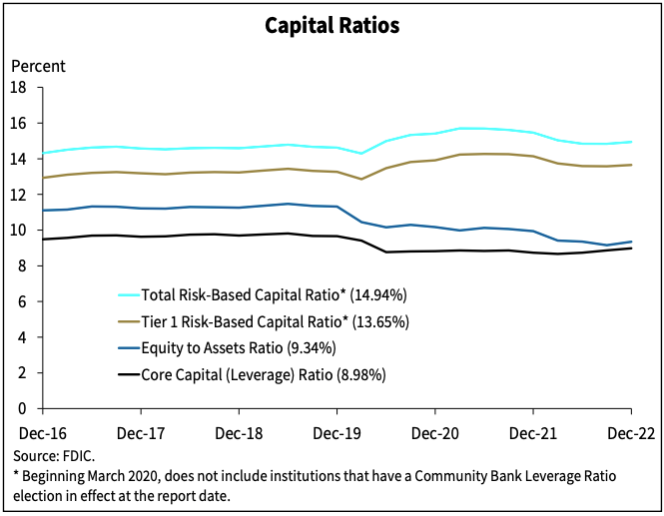

Another reason not to fear a new financial crisis now is that the U.S. banking system is extremely well-capitalized, with Tier 1 capital ratios at very solid levels and loan-to-deposit ratios at almost their lowest levels in 50+ years. By these key measures, the banking system is arguably the strongest it’s been in decades.

Nearly all large banks can meet withdrawal requests without selling illiquid assets or fixed-income assets at losses, and smaller banks have access to the Federal Reserve’s new lending facility to prevent forced sales.

Now, to be fair, I do believe actions today can have consequences in the future. For instance, the decision to make uninsured SIVB and SBNY depositors whole is likely to have serious implications in the future. There is also a good argument that every time regulators step in to provide liquidity and transfer risks onto their balance sheet, they are ultimately setting the stage for the next crisis. We may be talking about these very decisions when the next financial crisis does arrive – I just don’t think that’s now.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!

±