– by MITCH ZACKS –

The yield curve is often considered one of the best leading indicators for the U.S. economy, which also makes it an insightful leading indicator for U.S. and global stocks.

It makes sense why the yield curve matters so much. Banks borrow money and pay deposits at rates on the short end of the yield curve (short-term interest rates), and then they in turn loan money to consumers, homeowners, and businesses at the long end of the curve (longer-term interest rates).

So, what happens when short-term interest rates are higher than long-term interest rates, i.e. when the yield curve inverts? The answer is that net interest margins get squeezed, profits fall, and a bank’s incentive to lend money falls. As banks loan less, economic activity tends to follow.

This explanation, of course, is a very distilled version of how the yield curve affects economic activity. But I believe it’s a useful way to frame your thinking.

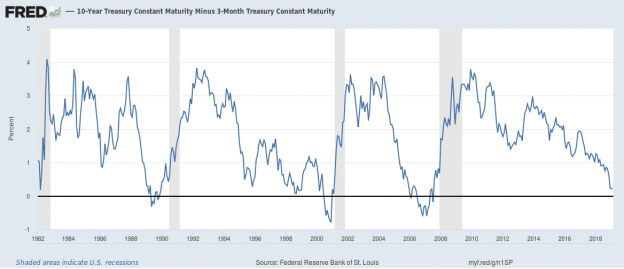

History gives us hard evidence of how the yield curve plays into economic cycles, and it underscores the crucial importance of watching the yield curve as an economic cycle develops and matures. If we define the yield curve as the 10-year U.S. Treasury minus the 3-month U.S. Treasury, we can see in the graphic below that an inverted yield curve (when the blue line dips below the solid black line) has preceded a recession (grey bars) like clockwork.

The Yield Curve Has Been a Reliable Predictor of Economic Recessions

Source: Federal Reserve Bank of St. Louis

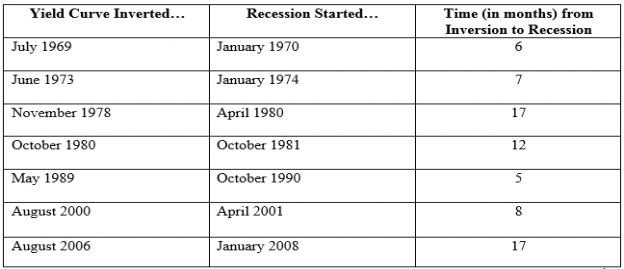

In fact, if we go back even further in history, we find that since 1970 there have been seven recessions and all of them were preceded by an inverted yield curve. The time it takes for a recession to take hold once the yield curve inverts vary throughout history, but it generally hasn’t taken very long – 5 to 17 months.

Source: Vanguard

Where Do We Stand Today? Is the Yield Curve Flashing Recession?

Looking back at the first chart above, readers can see that the yield curve has been steadily flattening (approaching the zero mark) over the last five or so years. The spread between the 10-year U.S. Treasury and the 3-month U.S. Treasury was about 300 basis points at the beginning of 2014, and the spread has since dropped to 30 basis points by the beginning of February 2019.

We’re still not quite to ‚inversion‘ territory, though in my view, all signs point to the yield curve heading in that direction.

We at Zacks Investment Management expect the yield curve to continue flattening in 2019. The Federal Reserve has a key role in determining how quickly the yield curve could flatten, as they determine rates at the short end of the curve. Though recently the Fed has indicated a less hawkish approach to increasing rates, we would expect another rate increase or two in the offing perhaps later this year or early next.

Longer rates are a bit trickier to forecast, but I’d expect that modest long-term inflation expectations should keep long rates pretty subdued, and range-bound. I don’t really see a scenario where the 10-year U.S. Treasury goes much higher than 3% in 2019.

Taken together, the risk of an inverted yield curve in 2019 is high and rising, but not necessarily imminent. And even if it was, history suggests we’d have some time before a recession took hold. In short, it’s an indicator to watch perhaps more closely than any other, but it is not quite flashing recession.

Bottom Line for Investors

Our forecast for global, U.S. and U.S. corporate earnings growth has moderated since the beginning of the year but remains positive. Earnings outlooks have notably declined as the impact of the corporate tax cut fades and as the fate of global trade hinges on Brexit and a US-China trade deal. Even still, global economic activity from consumption to business spending to hiring remain primarily positive and point to continued late-cycle growth. If a yield curve inversion and accompanying recession are in the offing, I do not think 2019 will be the year they actually arrive.

So, instead of letting fears of a recession push you to make hasty investment decisions, I recommend staying focused on the long-term view, meaning focus on fundamentals instead of the daily price movements. To help you do this, I am offering all readers our Just-Released March 2019 Stock Market Outlook Report.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!