By MITCH ZACKS

The whirlwind of market volatility persists, with the stock market posting dramatic single-day moves that are frequently drawing comparisons to Black Monday (1987), the Great Depression, and the 2008 financial crisis.

It took some time, but the global response to the crisis is accelerating and strengthening. From a public health standpoint, countries are ramping up testing and placing restrictions on movement in an unprecedented effort to stem the spread.

From a monetary and fiscal stimulus standpoint, the Federal Reserve – using experience, hindsight, and referencing the 2008 financial playbook – has taken proactive measures to ensure the banking system remains healthy. The end goal is that we never relive the credit/liquidity crisis that took our financial system to the brink in 2008. So far, so good.

This past week, the Fed engaged in aggressive rate-cutting and launched a massive $700 billion QE program. It’s nearly impossible to imagine a scenario where banks do not have access to ample liquidity. The House of Representatives passed a stimulus package that the Senate appears poised to expand even further, with the potential to reach $750 billion. We can debate the efficacy of these monetary and fiscal stimulus measures, but the important point, for now, is that coordinated action is being taken.

Buying now is not necessarily a bad idea

To be clear on my views right now, the economic impact from supply and demand disruptions will result in negative growth for Q2 and cause a recession. Couple this with the emotional response to uncertainties surrounding the pandemic, and it is very normal for stock prices to be heading lower. I expect more market volatility in the coming weeks, but I also firmly believe that if your financial goals and objectives have not changed, then your portfolio allocation should not change either. Making portfolio adjustments in the midst of severe volatility is almost always a recipe for major mistakes. The history of financial crises and recessions very clearly shows that the best course of action is to continue to hold equities through the recession as opposed to trying to time the market. An investor will make more money holding equities through a bear market than trying to time the bear market, in my view.

I still very much view the current downside risk as event-driven – not as a systemic risk that will lead to a financial crisis. Governments and central banks are intervening to stabilize the economy and capital markets; the severity of the outbreak in China is abating quickly (signaling it can be contained), and the banking sector is very well capitalized. In my view, this looks and feels more like September 11, 2001 than it does the 2008 financial crisis. In both of those cases, the public experienced shock, confusion, and anxiety in the absence of information available to make rational evaluations. It takes time, but the information will come, the crisis will abate, and the markets will recover. As it has been the case with almost every historical bear market – if you do not have to sell for liquidity reasons, the best course of action is to hold through a bear market. If you have cash on the sidelines – buying now is not necessarily a bad idea, in my view.

Comparing the Current Pandemic to the Spanish Flu Pandemic of 1918 and 1919

World War I was raging when the Spanish flu pandemic arrived, infecting some 500 million people worldwide (27% of the population) and killing roughly 40 million people, including 675,000 in the US alone.

There are a lot of takeaways from the Spanish flu pandemic’s effect on the world, but the stock market’s response may be the most surprising. If you look at the Dow Jones Industrial Average during the apex of the outbreaks (there were a few waves) in 1918 and 1919, you find that the index rose by just under 17% with dividends reinvested. Economic production from the war no doubt boosted activity during that time, and euphoria when the war ended in 1918 likely also contributed.

In all, this history lesson should serve as a stark reminder that the world can endure a world war and a lethal pandemic and still fight and grow through it. When the final wave of the Spanish flu subsided in February 1919, the market surged some 50% through November of that year. When a fear fades, stocks can surge.

This is a Good Reminder of How the Stock Market Works

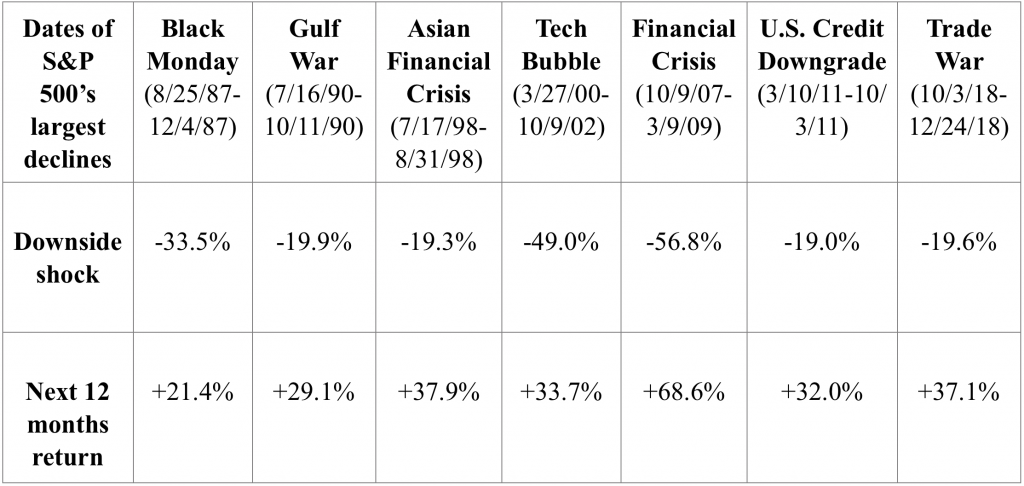

In times like these, it’s also important for investors to take a step back and remember how the stock market works. Investors get long stretches of gains when the market trends higher (approximately +400% in this most recent bull run), and then from time to time, we experience clusters of scary downside volatility and bear markets when 20+% is quickly wiped out. But then when the crisis fades and fears abate, the next twelve months consistently delivers a strong comeback:

Source: Blackrock

Long-term investors – and hopefully the folks who read my columns regularly – know that during a panic, an investor should look to snap up bargains as almost everyone runs for the exits. It’s the strategy of being “greedy when others are fearful,” as Warren Buffet put it. It sounds easy in theory, but it is very difficult in practice. In my view, now is a good time to buy stocks – it’s a better time than almost any other time since the ’08 crisis – it’s just psychologically almost impossible to implement. The history of the US economic system is a history of the triumph of the optimists. I believe the panic we see today will recede and money will transfer from those who panic to those who have a steady hand.

The issue is that there is no way to know when the market will stage its strong recovery, though history does tell us that it usually happens in close proximity to the scariest down days (much like the +9% surge we saw last Friday). Here’s a key stat to remember: over the last 20 years, 24 of the 25 worst trading days were within one month of the 25 best trading days. This speaks to the perils of trying to time exit and entry points during heightened volatility like we’re seeing right now. Doing so means potentially – if not probably – missing out on the market’s best rallies that every equity investor needs to drive long-term investing success.

Case in point: If you had invested $100,000 in the S&P 500 index on January 1, 2000, it would have hypothetically grown to $324,019 by December 31, 2019. This $100,000 investment would have endured the tech bubble bursting and the devastating 2008 financial crisis, and you would have still come out way ahead.

But if you decided during the tech bubble and 2008 financial crisis that you wanted to trade in and out of the markets to try and evade downside, chances are you would have missed some of the best rallies the market had to offer. Missing the 10 best days means your $100,000 would have only grown to $161,706. Missing the best 25 days would have meant losing money, with your investment shrinking to $82,256. Don’t try to time the market! Staying invested even in dismal-seeming times is the correct approach, in my view.

Bottom Line for Investors

As I mentioned before, volatility is almost certain to persist in the near term and the situation by the numbers will get worse before it gets better, in my view. But all of the uncertainty in the world cannot change the fact that bull markets follow bear markets, and bull markets almost always last longer with moves of far greater magnitude than the downside experienced. It’s just a matter of being patient now.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!