By MITCH ZACKS

The last few years offer a case study of how quickly energy markets can shift.

In 2020, the pandemic and ensuing shutdowns and restrictions saw oil demand plummet, sending prices into negative territory for a brief period. Margins for oil producers fell to multi-decade lows, and S&P 500 energy stocks fell by a third that year as earnings plummeted.

Prices rebounded in 2021, however, and then shifted into overdrive in 2022 due to supply constraints tied to the war in Ukraine, which sent the price of a barrel of crude oil above $100 a barrel. S&P 500 Energy stocks rebounded +54.6% in 2021 and are up +34.9% in the first three quarters of 2022.

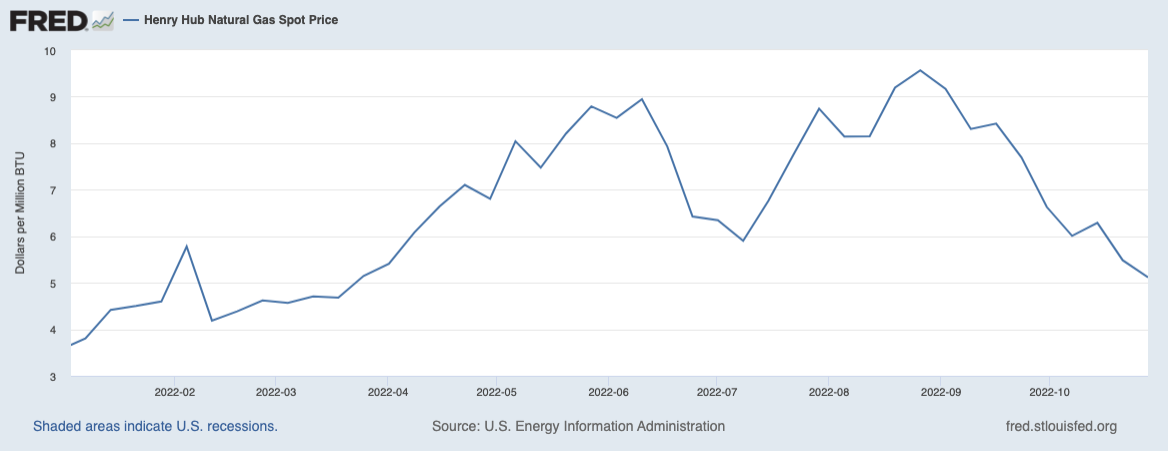

Natural gas prices have endured even more wild swings than oil. In April and May alone, prices soared over +60%, but then plummeted in June to finish the three months down -3.9%. Prices rebounded quickly over the summer, but as I write, natural gas prices have fallen again – down over -40% since late August.

Natural Gas Prices (Dollars per Million BTUs)

Along the way, investors have likely heard all manner of predictions and forecasts for where oil, natural gas, and other commodity prices are headed. Most of them have painted a dire picture for energy markets, one in which oil could rise above $200 a barrel and/or where many Americans would struggle to pay heating bills this winter.

Most of these predictions have been, and continue to be, wrong.

Though not widely reported, overall U.S. oil production is currently closing in on all-time highs. In August, U.S. oil output rose to 12 million barrels per day, which is just one million barrels a day shy of a record. Natural gas prices have also moved in unexpected ways. Warmer-than-expected weather in September meant less gas was consumed for air conditioning, which happened at the same time as record domestic production (100 billion cubic feet a day) in the U.S. The result has been gas-storage facilities filling up quickly ahead of winter.

Most warnings dealing with energy have said that a crisis is looming, but markets have been moving in the opposite direction. Oil and gas supplies have been growing, not dwindling.

For investors, rapid shifts in the energy markets should be expected, but they should not mean rapid shifts in your portfolio positioning. Since earnings for oil and gas companies are impacted by price more than anything else, and since we know prices can be wildly volatile and largely unpredictable, I think it’s wise not to have Energy exposure too much higher or too much lower than your benchmark. There is simply too much risk that prices will move in a direction that runs counter to your wager.

Bottom Line for Investors

The Energy sector’s earnings are on track to grow +142.6% this year, which makes the sector responsible for the S&P 500 earnings growth we’ve seen in 2022 year-to-date. In Q3 2022, total S&P 500 earnings are currently expected to be up +2.0% from the same period last year on +10.7% higher revenues. But excluding contributions from the Energy sector, Q3 earnings for the rest of the index would be -5.6% below the year-earlier level.

A rational investor might wonder: if the Energy sector is the only area of the market generating positive earnings growth – and huge positive earnings growth at that – then why not substantially increase portfolio exposure to the sector while the earnings outperformance persists? The reason is that we cannot assume oil and gas prices are going to remain stable or rise going forward from here. Current trends indicate the opposite – elevated prices incentivize more production, as we’re seeing now with near-record oil and gas production in the U.S. Bringing on more supply is good from a consumption and manufacturing standpoint, but it also moves global supply and demands back into balance – which could ultimately pressure prices lower. Being heavily overweight to Energy when oil and gas prices are falling is not where an investor wants to be.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!

±

Was ist eigentlich Klimawandel? Gibt es das auch in den USA?

Ich glaube schon. Und im Gegensatz zu Deutschland bauen sie in den USA massiv aus bei Wind- und Solarenergie.